Carillion PLC Finances Report

| ✓ Paper Type: Free Assignment | ✓ Study Level: University / Undergraduate |

| ✓ Wordcount: 1795 words | ✓ Published: 12 Aug 2019 |

Introduction

Carillion PLC is a construction and facility management supplying services organisation. The company exposed as a leading corporation in the UK in the last few decades. The company successfully executed multiple construction projects of various size and extent including multimillion pound private-public partnership (PPP) contracts and are amongst the largest contractors delivering maintenance and catering to the U.K’s National Health Service (NHS) Hospitals, Her Majesty (HM) Prisons Service and National Education Service (NES). However, despite its high ranked profile among ventures globally, Carillion Company has been in trouble due to massive losses leading to bankruptcy and collapse (Loxley, 2018)

Further research while analysing the operations of Carillion PLC, which has performed well initially, led to various findings on the cause of its failure. The company encountered challenges associated with factors that could have been controlled by the directors and management. Thus its failure was likely to be predicted.

Business and Finances Management

Business organisations must have excellent financial management skills in order to expand, be profitable, as well as compete well with other companies in the same industry. In case of financial difficulties, a venture is likely to collapse. In the Carillion case, the financial challenge was one of the factors that contributed to its downfall since the company could not meet the cost of operations such as clearing of debts (Mor, Conway, Thurley and Booth, 2018). With low returns, a business is likely to incur huge debts.

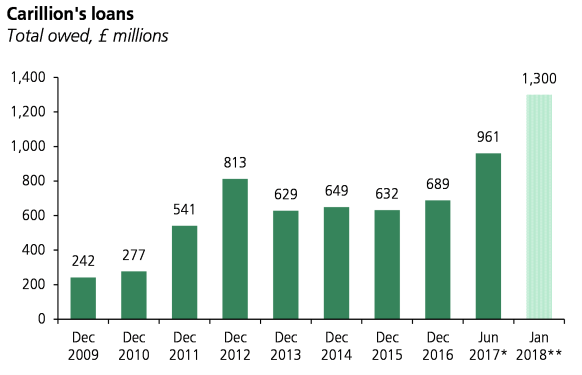

The company had developed a high standard and complex management structure and internal organisation that needed vast sums of money to run and manage. According to Karadag (2015), strategic management of a business involves attaining a sustainable positive performance and must have essential elements, such as environmental scanning, strategy formulation, strategy implementation, evaluation, and control. However, for Carillion, the management failed to focus on strategies that could sustain the business leading to huge losses (Arnaboldi, Lapsley, Steccolini, 2015). In addition to that, statistics showing apparent financial decline as from 2008 to 2018, the Carillion’s loan debt was gradually increasing and finally reached the £1.3 billion mark. Moreover, this should have raised concerns about the possible failure. However, due to a lack of appropriate management decisions the failure had eventually occurred.

Figure 1: Carillion Loans in a million pounds

Liquidation

Before the company collapsed, it had issued three profit warnings. Additionally, there was an increasing profit deficit margin, and three major projects encountered delays due to quality issues that further increased losses. Despite that, the issues still were not focused on correctly to bring the venture back to profitability. Due to that, lenders declined further financing options as there were no more ways to recuperate the existing critical situation. The allegations were raised, and the court issued Carillion a compulsory liquidation order implying that Carillion assets were to be sold to pay out debts to its creditors. According to Lu Jin, Zhou and Wang (2016), the success of a business hinges critically on resource allocation since, without sufficient resources, ventures cannot achieve their goals. Since Carillion, did not have enough assets to sell, liquidation rather than the administration was the only option. According to various business commentators and individual managers, it was impossible for the company to continue with operations with low margins to cover its liabilities (Mor, Conway, Thurley and Booth, 2018). The government ordered an official investigation to look at the conduct of current and previous directors. Andonov, Eichholtz and Kok (2015) study revealed that institutional investors minimise agency conflicts by employing well-qualified specialised asset managers. Such experts can advise the management on the direction of the company and offer solutions to impending crises. The directors should have predicted the possibility of the company failure by analysing the performance trends, which possibly would have saved the company from compulsory liquidation. As the usual effect of such negative event The Carillion liquidation affected various subcontractors and suppliers, employees, pensioners and apprentices, lenders, customers across the world and joint ventures.

Pension Scheme

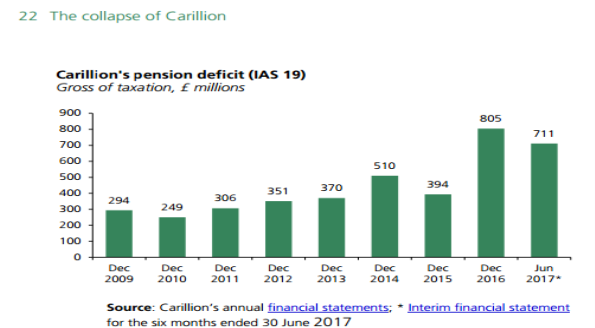

Among the FTSE 350 companies, Carillion’s pension deficit was among the largest ones. Carillion had pension schemes with more than 27000 members. Loxley (2018) noted that Carillion had pension deficit amounting to about £800 million putting the situation in a high risk. Under the solvency of the company, the Pension Protection Fund (PPF) was formed to assist in paying off compensation to members in the pension schemes. In the Carillion case, the management and directors delayed with planning on measures to implement prevention to the possible liquidation of the company. After insolvency, there was a huge deficit in the PPF compensation payments. Thus, raising the question of whether the directors could not foresee the possibility of underperformance due to huge liabilities.

Figure 2: Carillion’s Pension Deficit

Suppliers and Payment Terms

Business organisations need suppliers to ensure that operations are not interrupted for lack of adequate resources. There should also be a suitable payment plan for the suppliers for them to ensure a steady and timely supply. The logistics and supply chain are concerned with planning and co-coordination of material flow from the source to the user as an integrated system for efficiency (Christopher, 2016). Carillion’s logistic and supply department failed to create an efficient system for settling payments leading to accumulation of huge debts. Failing to settle suppliers’ dues can lead to poor performance of a business. ‘Carillion owed £2 billion to its 30,000 suppliers, creditors, and sub-contractors and other Short-term creditors‘ (Mor, Conway, Thurley and Booth, 2018). However, the company management and directors failed to plan on suppliers’ debt settlements, which continued to rise.

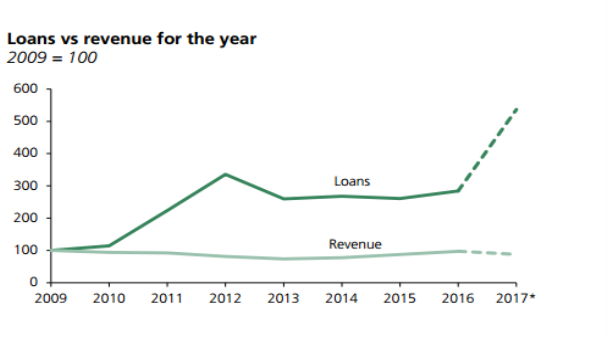

Figure 3: Loans VS payments

Employees

An organisation’s workforce is a valuable asset thus management of employees is very vital for increased performance. Paying the workers’ salaries, allowances, and other benefits promptly promote the growth of a venture. Carillion had employed more than 19600 employees in the UK and more others in other nations (Loxley, 2018). The employees and workers of today focus of money since they need to be financially stable to remain committed with the organisation. Asset management is vital especially in big ventures that deal with a large number of employees and have many investors (David Guest, 2002). The company could have chosen to lay off some employees instead of retaining them and failing to pay their salaries.

Joint Ventures and Partners

Some investments are either too risky to provide or too expensive for a single company to manage and run. Mergers and acquisitions help to solve the problem by companies coming together to share costs and benefits. Carillion had made some joint venture business with other companies. For example, Balfour Beatty was the leading contractors, and GallifordTry minor was jointly liable to raise cash for the projects (Mor, Conway, Thurley and Booth, 2018). They later pulled out from the partnership deal when they realised Carillion was heading to liquidity. According to Marion, Eddleston, Friar and Deeds (2015), alliance relationships have become so dependent on socio-emotional bonds and can thus be destructive to an emerging venture. This statement implies that Carillion got into many alliances yet it could not manage to sustain them financially. Such deals are significant causes of its failure, yet the management continued to form business relationships even when the company was failing.

Investigation

There was a need for investigations to be carried out on the Carillion Company to determine the ultimate cause for its failure. The company should have appointed experts to find the causes of poor performance. Soltani (2014) argued that “the ethical dilemma is coupled with ineffective boards, inefficient corporate governance and control mechanisms… moreover, dysfunctional management behaviour” (p. 251). The insolvency of the company attributed to the failure of its governance system that led to the inefficiency of the venture. Where was the management board? Was there coordination with other venture? What were the measures implemented to prevent the crisis?

The government had to appoint agencies to help in finding the cause of downfall and way forward. The investigating companies included the Insolvency Service, the Financial Conduct Authority, the Financial Reporting Council and the Pensions Regulator (Davis 2018). Parliamentary committees were also formed to investigate the company in order to research issues affecting an organisation which can reduce the chances of failure in the future.

Conclusion

Company faced with challenges during the course of its operations leading to losses, closure, and liquidation. Due to poor management and poorly defined structures, the company had problems settling debts and paying employees’ salaries. The problems that faced the company were not spontaneous and could have been addressed to safe its collapse. Even after the profit warnings, the management did not take steps to save the company. The failure was, therefore, predictable since the company experienced financial difficulties for a long time in which profits reduced while liabilities increased. The study contributes significantly to business entities as it reveals that early prediction of business failure is possible same as measures taken to stabilise operations.

References

Almaric, F., 2005. Pension funds, corporate responsibility and sustainability. Ecologic Economics, 59, pp.440-450

Andonov, A., Eichholtz, P. and Kok, N., 2015. Intermediated investment management in private markets: Evidence from pension fund investments in real estate. Journal of Financial Markets, 22, pp.73-103.

Arnaboldi, M., Lapsley, I., Steccolini, I., 2015. Performance management in the Public Sector: The Ultimate Challenge. Wiley Online Library

Bhasin, M.L., 2016. Survey of Creative Accounting Practices: An Empirical Study. Wulfenia Journal KLAGENFURT, 23(1), pp.143-162.

Christopher, M., 2016. Logistics & supply chain management. Pearson UK.

Davis R., (2018). Former directors face questioning over Carillion’s collapse. The Guardian, Monday, 6th Aug 2018. https://www.theguardian.com/business/2018/aug/06/former-directors-face-questioning-over-carillions-collapse

Farrell, J. and Shoag, D., 2016. Asset management in public DB and non-DB Pension Plans. Journal of Pension Economics & Finance, 15(4), pp.379-406.

Karadag, H., 2015. Financial management challenges in small and medium-sized enterprises: A strategic management approach. EMAJ: Emerging Markets Journal, 5(1), pp.26-40.

Loxley, J., 2018. The Collapse of P3 Giant Carillion and Its Implications. Canadian Centre for Policy Alternatives.

Lu Jin, J., Zhou, K.Z., and Wang, Y., 2016. Exploitation and exploration in international joint ventures: moderating effects of partner control imbalance and product similarity. Journal of International Marketing, 24(4), pp.20-38.

Marion, T.J., Eddleston, K.A., Friar, J.H. and Deeds, D., 2015. The evolution of interorganizational relationships in emerging ventures: An ethnographic study within the new product development process. Journal of Business Venturing, 30(1), pp.167-184.

Mor, F., Conway, L., Thurley, D., and Booth, L., 2018. The collapse of Carillion.

Parkinson, M.M., 2018. Corporate Governance in Public Companies. In Corporate Governance in Transition (pp. 9-41). Palgrave Macmillan, Cham.

Sarmad, M., Ajmal, M.M., Shamim, M., Saleh, M. and Malik, A., 2016. Motivation and Compensation as Predictors of Employees’ Retention: Evidence From Public Sector Oil and Gas Selling Organizations. Journal of Behavioural Sciences, 26(2).

Soltani, B., 2014. The anatomy of corporate fraud: A comparative analysis of high profile American and European corporate scandals. Journal of business ethics, 120(2), pp.251-274.

Figures

Figure 1: Carillion Loans in million pounds………………………………….……2

Figure 2: Carillion’s Pension Deficit………………………………………………4

Figure 3: Loans VS payments……………………………………………………..5

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this assignment and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal