Project Finance for Independent Power Plant Construction

| ✅ Paper Type: Free Essay | ✅ Subject: India |

| ✅ Wordcount: 2132 words | ✅ Published: 21 Apr 2021 |

1. Introduction

The power demand in India has increased rapidly over the past decade. According to International Energy Agency (2015), India’s consumption of energy has grown by 200% since 2000 following its economic growth. Moreover, due to the lack of the government budget, 240 million people in India still do not have access to electricity (International Energy Agency, 2015). Furthermore, the government should build the new infrastructure using not only its budget but also incorporate private sector on concession scheme to address this issue. Following such views, this essay will explain an example of the financing mechanism of concession project. This article will first describe preliminary analysis on how to finance the project. Then the major risk will be identified in the second section. In the final section, several concluding remarks ad summary will be included.

2. How to finance the project

1. Background

In Year 1, India government procured a new gas powered Independent Power Plant (IPP) with the capacity of 150 Mega Watts through concession mechanism with Build Own Operate Transfer (BOOT) strategy using project finance mechanism. According to Merna and Njiru (2002) incorporating private investment in BOOT strategy can ease the government budget constraint.

In BOOT strategy, the private sector is expected to build, own and operate the infrastructure for a limited time before transferring its ownership and operating right free of charge to the host government at the end of concession period (Jefferies et al., 2002). In this case, the government decides the concession period is 11 years including one year construction period.

Project finance is used to fund the project because it needs a significant amount of initial investment and a long period to start to generate income. Project finance is a system to fund the major capital-intensive infrastructure project that relies on the ability of the project’s future cash-flow rather than collateral or any other guarantees (Grimsey and Lewis, 2004; Amoa-gyarteng, 2015).

In Project Finance, the promoter shares all risk to other parties by setting up a Special Project Vehicle (SPV). SPV is an independent project entity financed with non-recourse or limited recourse debt specifically built for the project. SPV will deal with all of the project contract and agreement as shown in Figure 1. (Merna et al., 2010)

Government

Constructors

O & M

Concession agreement

Supplier

Off-taker

SPV

Shareholder

Lender

Figure 1. Contract structure in Project Financing adapted from Merna and Njiru (2002)

To attract the investor, State Owned Transmission Company guarantees to purchase 100% of the electricity produced by the IPP through off-take contract. Off-take contract is the agreement to buy the amount of output for a particular volume and price (Merna and Njiru, 2002). In the supply side, State Owned Gas Supplier agreed on a supply contract with a fixed price over the concession period. Supply contract is an agreement in which the supplier is bound to deliver a material needed for the project to operate (Merna and Njiru, 2002).

2. Preliminary estimations

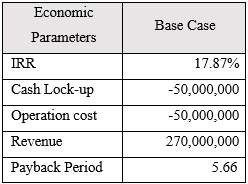

The SPV is analyzing project viability through its Internal Rate of Return (IRR). The SPV sets the minimum of accepted IRR of 10%. IRR is the rate that makes the present value of the investment predicted to be equal to the present value of revenue generated (Merna et al., 2010). Moreover, the project is seen profitable if the IRR above the accepted IRR. For calculation, the following estimations are made.

- Capital expenditure: US$50 million.

- Annual Operating and Maintenance (O&M) cost: US$5 million.

- Annual cost of Gas: US$10 million.

- Plant Efficiency: 90% capacity

- Annual revenue estimation: US$27million.

- The Bank terms:

- Interest Rate: LIBOR (3%) + Margin (2%) = 5%

- Debt Service Cover Ratio (DSCR): 1.15

- Debt length: 5 years

- The project uses 80:20 debt to equity ratio. In this ratio, DSCR for the first year loan payment is 1.2 which meet the Bank requirement.

3. Cash-flow model

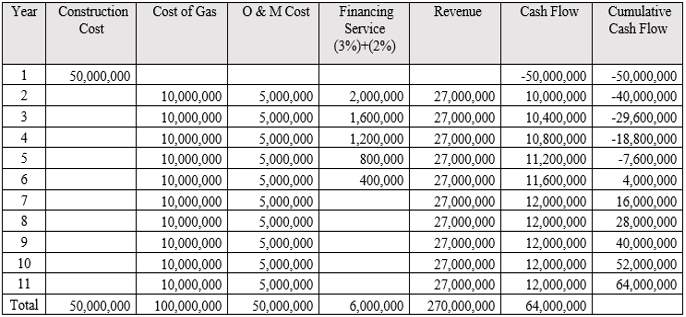

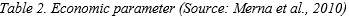

From the estimations, the SPV calculate cash-flow model to see the profitability of the project which can be seen in Table 1. The estimates are used to derive the estimated revenue, construction cost, cost of gas, operating and maintanance cost, and financing services.

Table 1. Cash-flow Analysis, adapted fromMerna et al. (2010).

Table 1 shows the income generated by the project on a yearly basis. Moreover, the project is predicted to produce total revenue of US$270 million, capital expenditure of US$50 million, the cost of gas of US$100 million, O & M cost of US$50 million, and financing service of US$6 million over the concession period. It can be seen from Table 1 that the IPP is expected to generate a profit of US$64 million over the concession period which is calculated as:

Profit = 270 million – 50 million – 100 million – 50 million – 6 million = US$64 million.

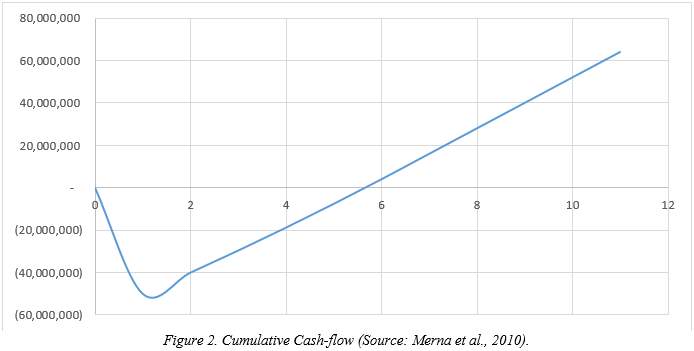

According to the cash-flow analysis, the IRR of the project is 17.87%. This rate is 7.87% above the minimum accepted IRR required by the SPV. Furthermore, the payback period of the project is 5.66. It can also be seen from Figure 2 that the project is starting to generate revenue right after the year 1 with cash lock-up on US$50 million. Summary of the project initial economic parameter is provided in Table 2.

In this calculation, no effect of inflation and discount rate is taken into account. This calculation is only to determine the project’s commercial viability by considering initial economic parameter (Merna et al., 2010). It is apparent from the initial economic parameter that the project is viable and meet the SPV minimum acceptable rate of IRR. However, the effects of significant risks on the project need to be considered to see if the project is still profitable with the major risk incorporated (Merna et al., 2010).

3. Identify major risk over the concession period

1. Major risk identification

The SPV need to convince the potential stakeholders that the risk within the project is well identified and managed to avoid financial difficulties in the concession period (Gatti, 2008; Merna et al., 2010). Risk identification is to consider the risks that may affect the project (Merna and Al-thani, 2008). Furthermore, Merna and Al-thani (2008) argue that the identification should consider the effect of both internal and external risk on the cost, timetable, and goals of the project.

In BOOT project, Merna and Njiru (2002) define two types of risk namely global and elemental risks. Global risks refer to the project’s external risks which are uncontrollable. In contrast, elemental risk is the inherent project risks which are controllable (Merna and Smith, 1994). Considering some mitigations already in place, the major global and elemental risk that still exists in this IPP project are (Merna and Smith, 1994; Merna et al., 2010):

2. Global risks

Political risk:

Political risk is an exposure of potential loss of foreign lending or investment because the uncertainty of political environment which is under the control of host government (Merna and Njiru, 2002). The promoter of the concession project usually a foreign investor, therefore has a high exposure to political risk, for instance, change of regulation, corruption, change in government regime, etc. (Merna and Smith, 1994).

The political risk of concession project in India is perceived high. Gupta and Sravat (1998) suggest the Dabhol Power Project in 1992 as a good example of India’s political risk. When the Dabhol Power Project was being constructed in 1995, the host state government was changed to a new regime which later on decided to stop the project construction (Gupta and Sravat, 1998). Thus, the project bore a significant loss until it was renegotiated and revived in 1996 (Gupta and Sravat, 1998).

Also, according to Transparency International (2015) the Corruption Perception Index of India ranked 76 out of 168 countries with the score of 38 out of 100. The index implies that the risk of corruption in India based on expert and business practitioners is still relatively high.

Gatti (2008) suggests two ways to deal with the political risk of the project. The first is to negotiate with the host government for a guarantee of favorable conditions for the project. The second is incorporating insurance to mitigate the political risk (Gatti, 2008). Thus, both the government and the promoter should cooperate to make a good political condition for the project.

Environmental risk:

Environmental risk is related to any possible adverse impact caused by the project to surrounding environment (Gatti, 2008). Also, the exposures on the potential loss of this issue are caused by several factors i.e. the leaked on gas transmission, leaked on waste treatment, and pollution where the project should pay for the cost of environmental improvement if this risk occurs. Moreover, several countries including India has a restrictive emission regulation regarding power plant construction (Central Pollution Control Board, n.d.; Gatti, 2008).

Market risk and supply risk

Market risk is vital for the project because the future cash-flow of the IPP project depends on the ability to sell the power to the user. Moreover, Golden and Min (2012) who researched the theft and loss of electricity in India from 2000 to 2009 conclude that India has a high rate of power theft.

Another major constraint of the future cash-flow is the supply of gas for the plant to produce the electricity. However, the existence of the off-take and supply contract has reduced both supply and market risk of future production respectively, furthermore, enhancing the feasibility of the future cash-flow (Merna and Njiru, 2002; Byoun et al., 2013).

3. Elemental risk

Construction risk:

The construction phase is a crucial phase of the project which is also involving a significant cash outflow. The construction risk is the potential loss because of the deviation of construction cost and completion time (Gatti, 2008). For instance, the construction risk can be in the form of non-completion, delayed completion, cost overruns, or the project finished with deficiency. However, the project can use turnkey contract with lump-sum payment to reduce the project exposure on construction risk (Merna et al., 2010).

Operation risk:

The operation risk is the vulnerability of loss because of poor O & M management, the increase of consumable material prices, or process interruption due to damage or force majeure. For example, if the plant is running below estimation (90% capacity), it could directly decrease the revenue and the cash-flow. Therefore, to mitigate this risk, the project should clearly define the level of production in O&M agreement (Gatti, 2008).

Interest rate risk:

The interest rate of the debt depends on the LIBOR (London Interbank Offered Rate) which is subject to change based on the market. Change in interest rate will affect the annual financing service payment to the lender. The SVP could implement interest rate swap or negotiate for a fixed rate if possible to reduce the risk of interest rate (Gatti, 2008).

4. Conclusion

This essay presented an example of how to finance the construction of 150 Mega Watts IPP project in India. In the first part of this article, the SPV calculated the cash-flow based on preliminary estimations. From the cash-flow calculation, the project generates an IRR of 17.87% which is 7.8% above the minimum accepted IRR (10%). Hence, the SPV accepted the project financial viability. However, the SPV need to assure the future project cash-flow by demonstrating a high capability to manage the project risk (Merna et al., 2010).

The second part of this study has shown that political risk in India is perceived to be relatively high. It was also shown that the existence of the off-take and supply contract had reduced the market and supply risk significantly. Moreover, this essay suggested both the promoter and the host government to cooperate on minimizing any significant risks to make a good investment climate. Although, the major risk of the project cannot be fully removed, but it can be lowered to meet the project requirement.

5. References

Amoa-gyarteng, K. (2015) ‘Benefits of a Project Finance Approach to Infrastructure Development in Ghana : The Need to Adopt a Public Private Partnership Model.’ Research in World Economy, 6(1).

Byoun, S., Kim, J. and Yoo, S. S. (2013) ‘Risk Management with Leverage: Evidence from Project Finance.’ Journal of Financial and Quantitatif Analysis, 48(2) pp. 549–577.

Central Pollution Control Board (n.d.) Pollution Control Implementation DIvision – II. [Online] [Accessed on 15th November 2016] www.cpcb.nic.in/divisionsofheadoffice/pci2/ThermalpowerPlants.pdf.

Gatti, S. (2008) Project Finance in Theory and Practice. Project Finance.

Golden, M. and Min, B. (2012) Theft and Loss of Electricity in an Indian State. London.

Grimsey, D. and Lewis, M. K. (2004) Public Private Partnerships: The Worldwide Revolution in Infrastructure Provision and Project Finance. Cheltenham: Edward Elgar Publishing.

Gupta, J. P. and Sravat, A. K. (1998) ‘Development and project financing of private power projects in developing countries : a case study of India.’ International Journal of Project Management, 16(2) pp. 99–105.

International Energy Agency (2015) India Energy Outlook. World Energy Outlook Special Report.

Jefferies, M., Gameson, R. and Rowlinson, S. (2002) ‘Critical success factors of the BOOT procurement system : reflecections from the Stadium Australia case study.’ Engineering, Construction and Architectural Management, 9(4) pp. 352–361.

Merna, A., Yang, C. and Al-Thani, F. F. (2010) Project Finance in Construction. John.

Merna, T. and Al-thani, F. (2008) Corporate Risk Management: 2nd Edition. West Sussex: John Wiley & Sons.

Merna, T. and Njiru, C. (2002) Financing Infrastructure Projects. London: Thomas Telford.

Merna, T. and Smith, N. J. (1994) Projects Procured by Privately Financed Concession Contracts. Manchester: Institute of Science and Technology. Project Management Group.

Transparency International (2015) Transparency International – Country Profiles. Coruption Perception Index. [Online] [Accessed on 15th November 2016] www.transparency.org/country#IND.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal